It is customary for many elderly individuals to avoid creating a Will due to considering it a taboo. Nevertheless, opting not to draft a Will could potentially create more difficulties for your family members rather than being of assistance to them.

Let’s have a general run through on how Wills work. When your parents pass away with a Will being written beforehand, things will be proceed must smoother compared to without a Will. Their assets such as properties, bank accounts, investments and so on will be distributed to the beneficiaries which are usually their closet kin such as spouse and children. Everything will be much easier if your parents have no debts as if they have debts then the priority to clear the debts comes first.

What occurs if your parents did not create a Will? What is the outcome in that scenario?

In the event that your parents did not leave behind a Will, the Malaysian Government will take possession of your parents’ assets until either you or another lawful beneficiary steps forward to assert ownership. This process entails initiating a petition through the Court. Upon submission, the Court will issue a Letter of Administration (in cases without a Will) instead of a Grant of Probate (in cases with a Will). This document serves as evidence of the Court’s authorization for the rightful beneficiary to manage the deceased individual’s estate.

What’s Next?

The Administrator will need to locate all the assets left behind by the deceased, which can be a time-consuming process due to the lack of guidance regarding the nature and location of these assets. Once all the assets are identified, the Administrator will be responsible for settling any outstanding debts and unpaid taxes using the assets of the deceased. After the complete clearance of debts, the remaining assets will be divided following the guidelines of the Distribution Act 1958. (It’s important to note that there are variations in asset distribution between West Malaysia, East Malaysia, Muslims, and Non-Muslims.)

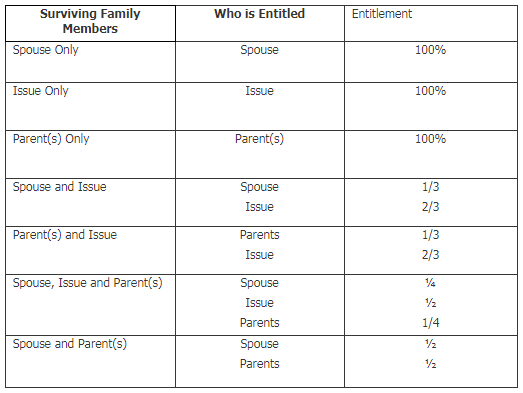

In the case of West Malaysia’s Non-Muslim population, the conventional approach involves prioritizing distribution among immediate family members. If a living spouse is present, they will receive a portion first. Subsequently, the children will equally share the next portion. Notably, relatives beyond the immediate family will not receive any portion from the deceased’s assets. Please refer to the distribution chart as below.