🔄 You may want to change who gets what

Relationships Change.

Life events like marriage, divorce, or estrangement may affect who you want to benefit.

You might want to include new family members, close friends, or even charities.

💼 You’ve acquired new assets

You may have acquired new assets, such as real estate, investments, or business interests.

It’s wise to designate different beneficiaries for each property to reflect your current intentions and family dynamics.

This approach allows you to tailor distributions based on each beneficiary’s needs, relationship, or financial situation.

It helps avoid multiple joint ownership, which can lead to:

- Disputes over sale or management

- Legal complications in decision-making

- Strained relationships among heirs

⚖️ Relationship turns sour?

Relationships can change—someone you trust today may become distant or unreachable in the future.

You should ask yourself:

Is this person still willing and able to act when the time comes?

Would your dependants be able to locate them easily?

If your executor, guardian, or trustee becomes uncooperative or estranged, it may delay or complicate your estate administration.

☠️ Death of Witnesses

The death of a witness does not cancel or revoke your Will. However, it may cause delays or extra steps during the probate process.

This may open the door for someone to challenge the Will, claiming it may not have been properly signed or witnessed.

To avoid complications, you can rewrite your Will and appoint new witnesses.

This helps ensure a smoother, faster, and more secure grant of probate.

⚠️ Will Without a Residuary Clause

Many self-written Wills forget to include a residuary clause, which covers leftover or unallocated assets.

This Can Lead to Partial Intestacy!

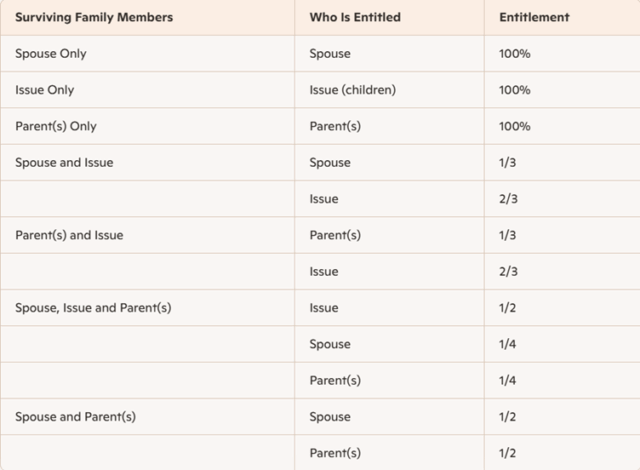

If partial intestacy occurs, the Distribution Act 1958, Section 8 applies to allocate unaddressed assets.

Is this what you were looking for?

💡 Final Tip: Review your will every 3–5 years or after any major life event. It’s a simple step that can save your loved ones a lot of stress down the road.

You may make an appointment with our legal advisor-Chelsia here: https://calendly.com/finex-and-co-legacy-advisory/tea-talk-with-legal-expert